Just when we thought it could not get any worse, a 20,000 TEU Evergreen vessel is currently stuck in the Suez Canal, blocking over 100 ships on either end of the canal from passing. The Evergiven ran aground due to weather issues, and is basically sideways in the canal. There is a massive effort going on to move the vessel and get it back on track. Approximately 50 vessels pass through the canal each day, and the longer the Evergiven is stuck, the longer the backup and more schedule delays. Click here for a full report by the New York Times on the Evergiven situation.

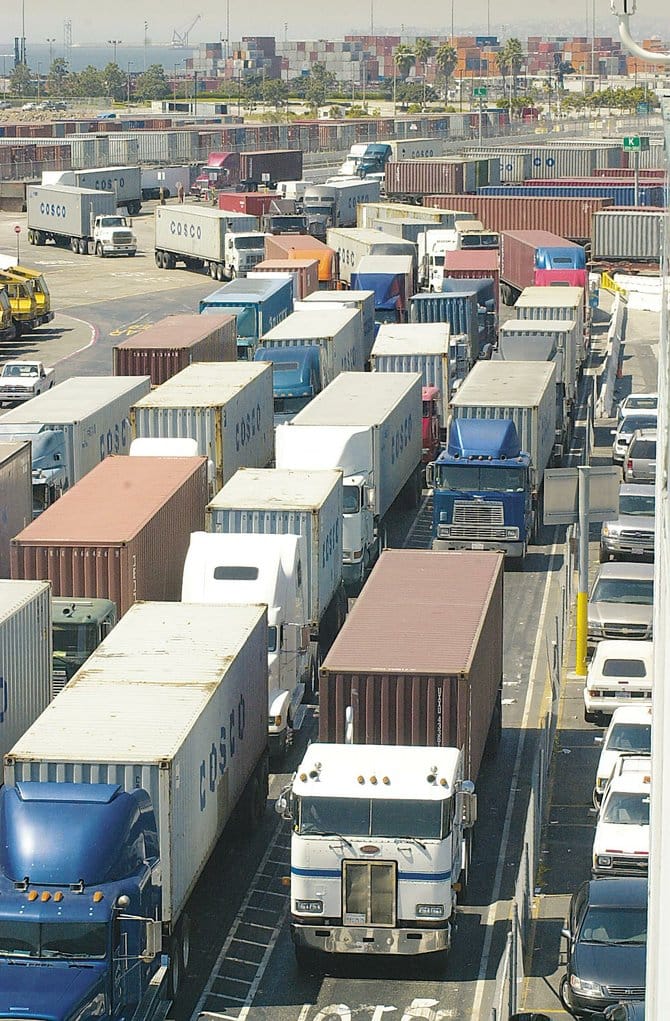

There are a few bright spots to report. As of yesterday, only 25 vessels were waiting for berths outside the ports of Los Angeles and Long Beach, down from the peak of 40 vessels. We are also seeing better throughput onto rail at the port of NY/NJ. However, the congestion issues and lack of equipment continues to deteriorate in many areas. Italy is incredibly hard hit, with literally no equipment available for loading and no space on vessels. Northern Europe is also struggling, and cargo is being rolled from one week to the next due to overbookings and congestion at hub ports such as Rotterdam. New Zealand continues to see huge problems in the port of Auckland with berthing delays and vessels skipping this key port, trickling down to a lack of equipment and massive delays in exports. South America is also suffering, with space restrictions implemented to clear out congestion which expected to continue until mid-April, especially for cargo destined to the US West Coast.

For Canadian-bound cargo, we are keeping a close eye on the labor negotiations at the port of Montreal with the potential for a strike at the port looming large. Canadian importers are looking at contingency plans to utilize other ports, but should a strike happen, congestion and delays will quickly pile up in the other Canadian ports.

Congestion, equipment imbalance, and peak season surcharges are being implemented in many areas, and global shipping rates continue to tick upwards. When will this be over? Everyone in the industry has predictions, but most believe that the volumes of cargo will continue and rise as shopping, dining, tourism and travel reopen. The pent up demand is massive, and we expect to be in this current cycle until the end of the year.

Should you need any specific data on any region or port pairs, please let us know.